What are the challenges in the CRE asset class?

CRE loan and CMBS transactions are unique

There are various aspects that make CRE loan and CMBS transactions challenging to analyse consistently.

Capturing expected loss accurately

Addressing both default and recovery analysis consistently, efficiently and without double counting risks is a challenge in separate CRE loan default and recovery underwriting tools and CMBS cash-flow proceeds allocation tools.

Tailored Transactions

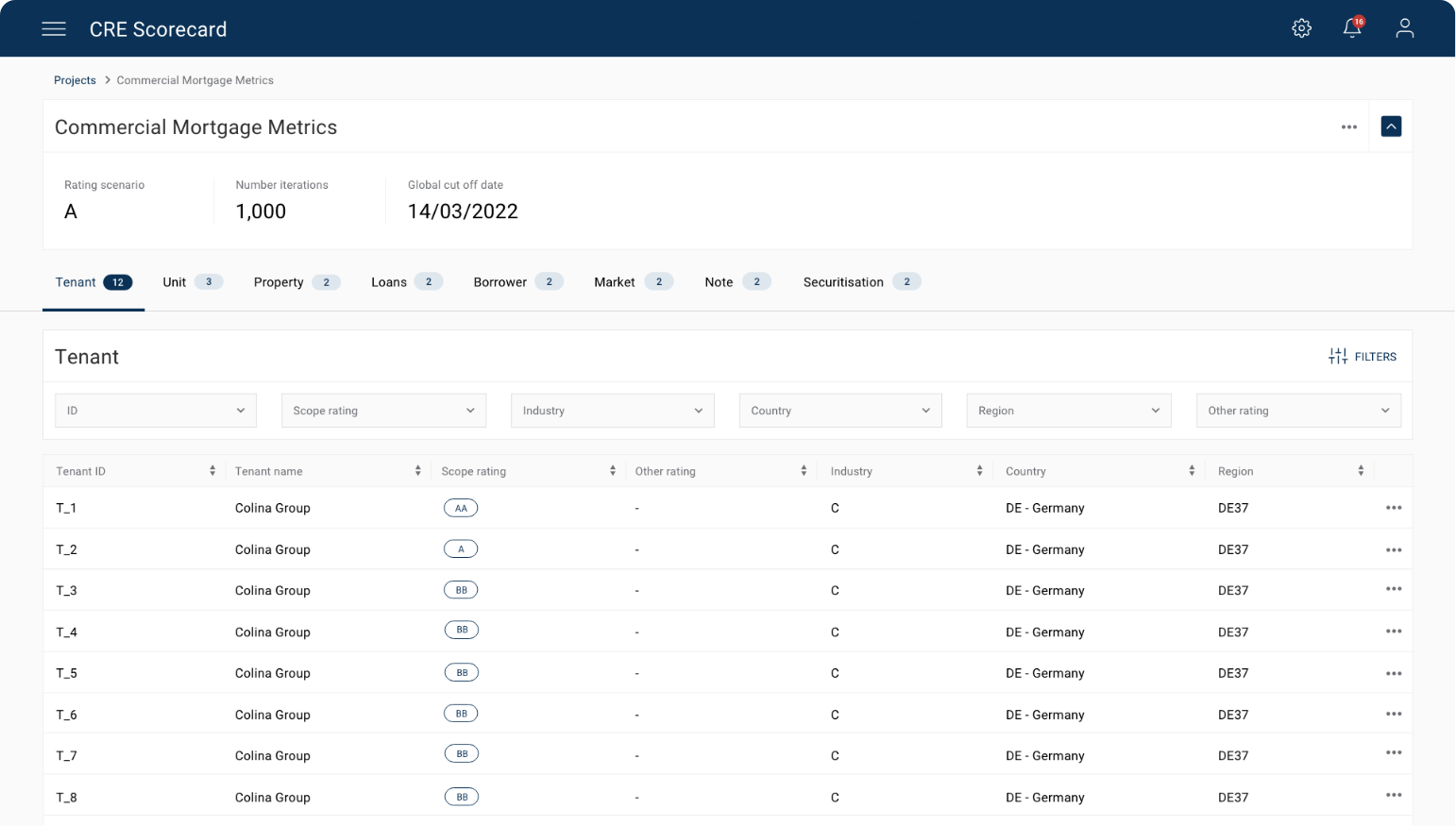

The bespoke nature of this asset class means you have to analyse many credit risk factors, relating to: Tenants, Collateral, Macro and market information, the CRE loan(s) itself, and CMBS, CRE CLOs, notes backed by debt fund structure (if applicable)

Challenging legacy solutions

Legacy solutions offer confusing user interface and limited flexibility which makes them challenging to implement and demanding to support.

OUR SOLUTION

CRE loan and CMBS Scorecard

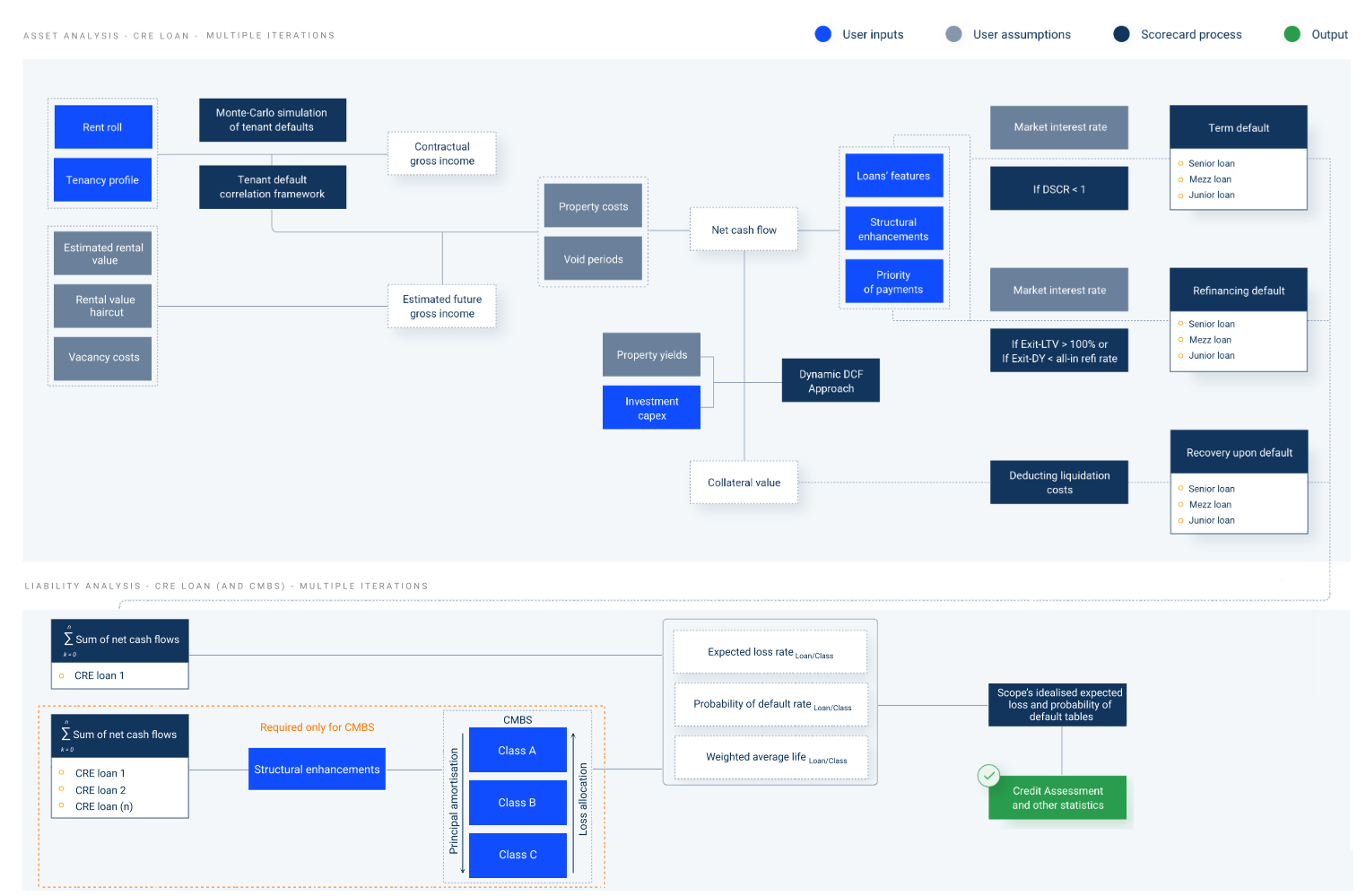

The analytical tool is generally consistent with Scope Ratings’ CRE loan and CMBS rating methodology. It relies on a bottom-up approach and a Monte Carlo simulation engine on tenant probability of default, with up to 200+ input factors capturing the specifics of each CRE loan or CMBS transaction.

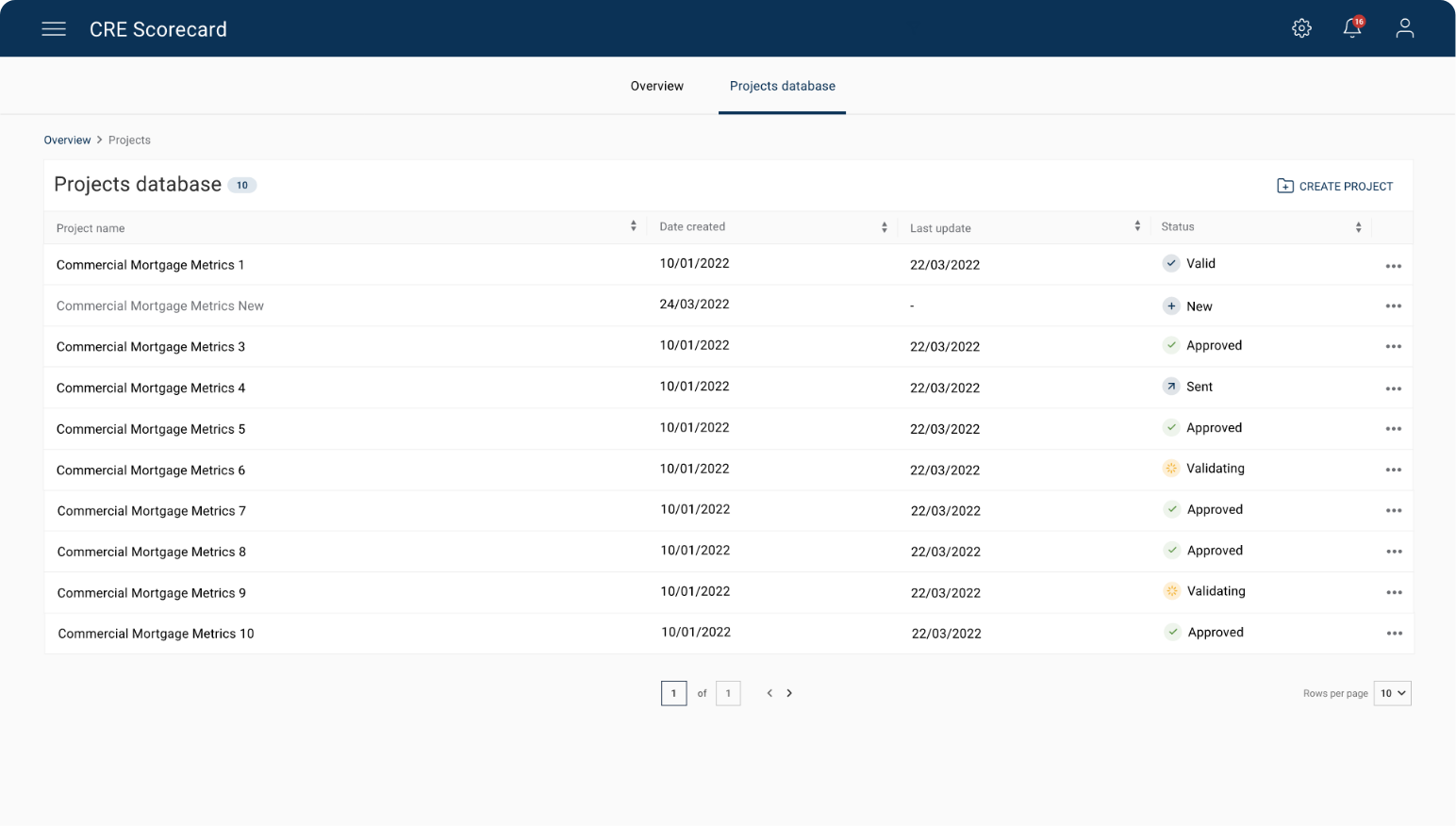

The Scorecard is available through the ScopeOne platform with multi-user access, supports workflow and auditability. The documentation includes a user guide on how to use the Scorecard, and Technical information describing how the Scorecard was developed and tested. An application training workshop is provided for users to learn how to apply the Scorecard independently. This is included at the outset and available on an ongoing basis for new staff or as refresher training.

Through the ongoing support, update and maintenance service clients have access to Scope Ratings’ analytical team for questions about the application of the CRE loan and CMBS Scorecard. Additionally, we ensure that the product continues to be generally consistent with Scope Ratings’ CRE loan and CMBS rating methodology. ScopeOne users can also access Scope Ratings’ credit ratings and research related to CRE loans and CMBS and any other asset classes

OUR SOLUTION

The CRE loan and CMBS Scorecard’s analytical process

CRE LOAN AND CMBS SCORECARD

Key benefits

Proven methodology

The Scorecard is generally consistent with Scope Ratings’ CRE Loan and CMBS rating methodology which uses an expected loss approach, combining term and refinancing default and recovery analysis within one tool.

Captures bespoke nature of CRE

A granular and flexible quantitative tool with 200+ potential input factors capturing the specifics of each transaction.

Enables business growth

The product is available through ScopeOne for all users within your organisation. Users can also access Scope Ratings’ credit ratings and research related to CRE loan, CMBs and other asset classes on ScopeOne.

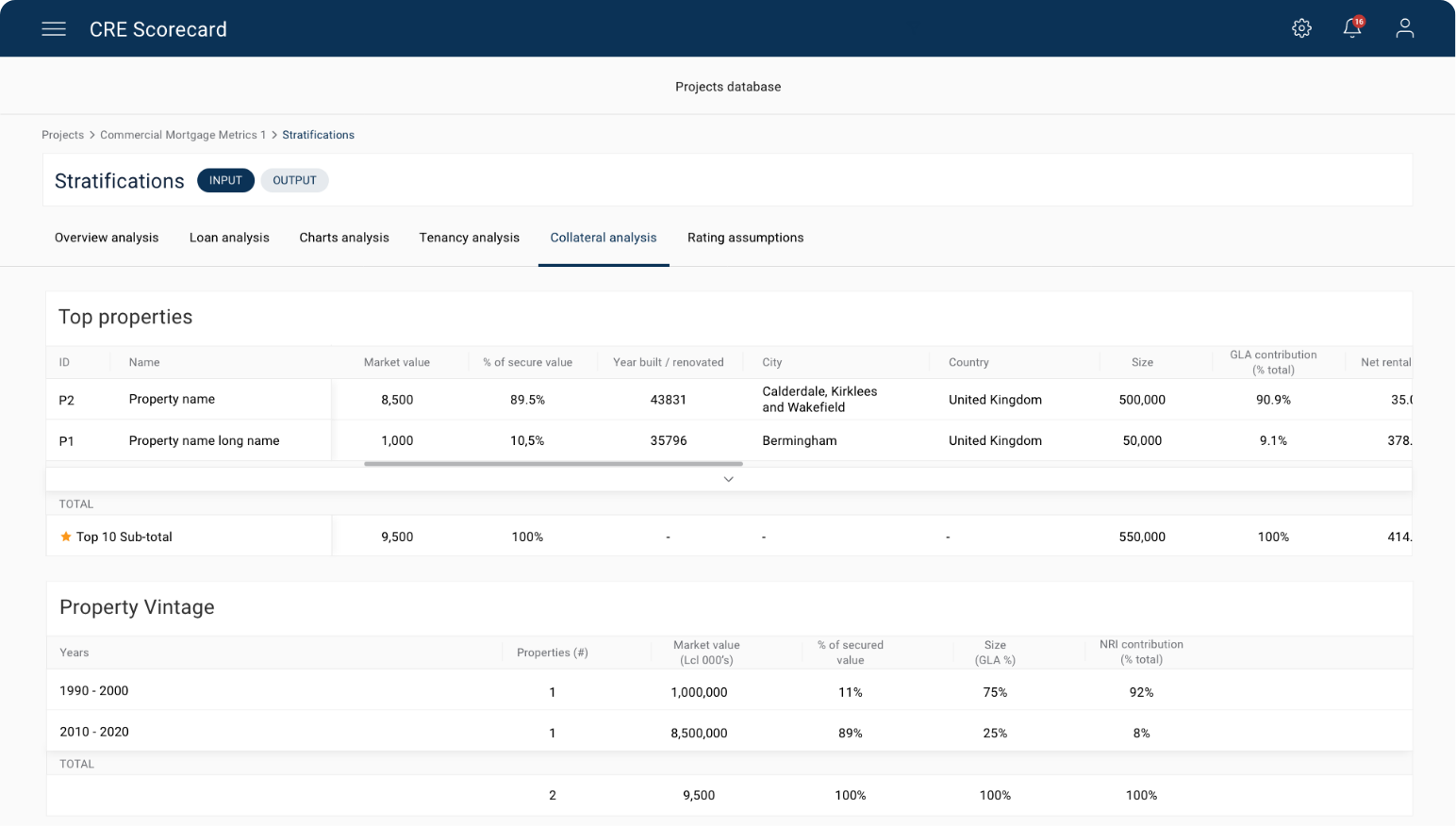

Stratifications dashboard

Dynamic and downloadable charts and tables on a transaction’s inputs and outputs for CMBS classes (if applicable), CRE loan(s), collateral and tenancy analysis.

CRE LOAN AND CMBS SCORECARD

Users obtain unique insights on their CRE loan and CMBS cashflow behaviour today and throughout the life of a loan/security through the lens of a rating agency (e.g. tenant defaults, loan metrics, term and refinancing loan defaults).

Dynamic and interactive charts and tables on a transaction’s inputs and outputs for (i) CMBS classes (if applicable), (ii) CRE loans, (iii) collateral and (iv) tenancy analysis

Drill-down functionality on various level of analysis (from CMBS classes to loan to property to unit levels) and time periods.

Export to Excel PDF or CSV supports internal and external reporting and presentations

Next steps