ESG IMPACT REVIEW

Understand the main drivers of corporate ESG impacts ranging from climate change to child labour to corruption across your portfolios. We provide a transparent overview to help you achieve a baseline for comparison of different corporates and industries. The insights provided are supportive of SFDR regulations.

For asset

management

For insurance

& pension funds

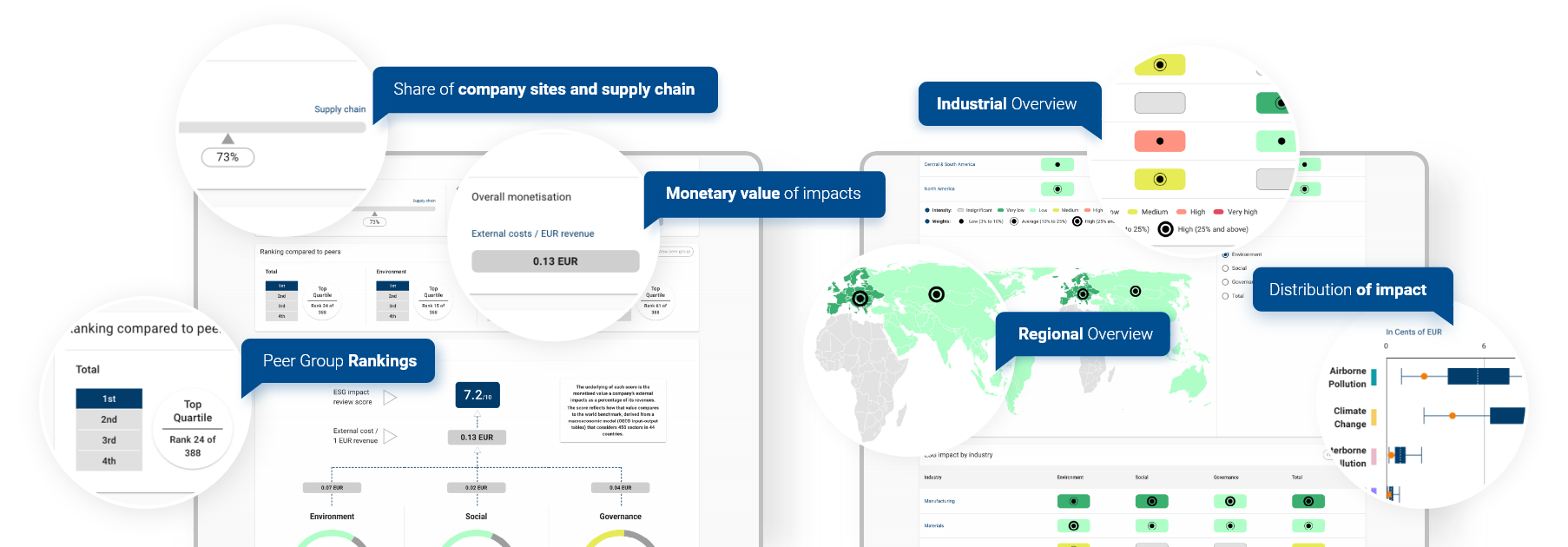

Scope’s ESG Impact Review offers a unique perspective on sustainability, as it reflects the intensity of a company’s global impact on ESG through its own activities and that of its supply chain.

Total portfolio coverage via our global database for public companies as well as a scoring tool for private companies.

The ESG impact review uses a macro-economic model, is independent from corporate self-disclosure, assesses the supply chain and shows the monetary value of impacts.

Our absolute ESG impact scores allow for peer comparability across industries, economic activities and regions.

Provides consistent measures of principal adverse impacts among corporates, whereby you can report and monitor negative impacts at the asset or portfolio level as required by SFDR regulations.

*This is applicable to all corporates, including non-listed companies and SMEs.

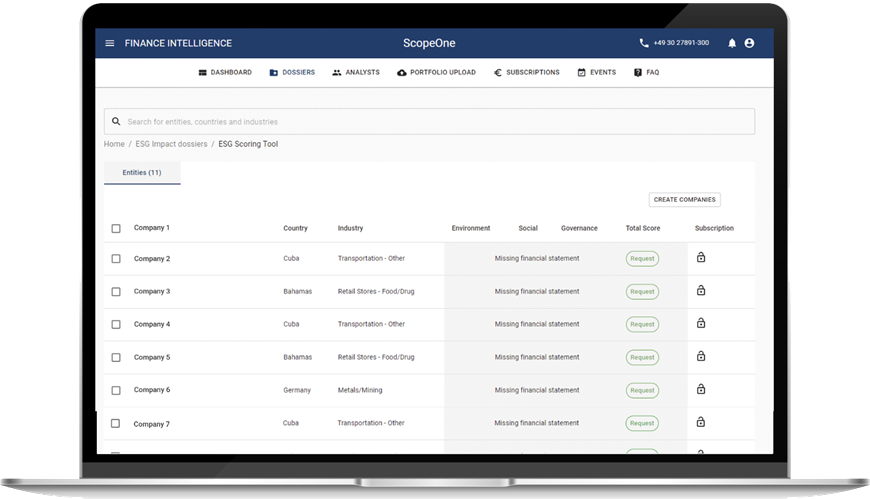

Our Scoring Tool lets you expand the range of your ESG analysis to include private companies in your portfolio by using the methodology of our ESG Impact Review. The Scoring Tool can be applied to any financial or non-financial company for which you have the relevant input data: the geographic location of the company's activities and a breakdown of its revenues by sector.

DOWNSTREAM FOR BANKS AND CORPORATES

Unlike the common approach of feeding analysis from self-disclosed corporate data, which is non-standardised, Scope ESG Review is based on reliable macro-economic data provided by international institutions such as World Bank, OECD, ILO, UNICEF and more.

Unlike other methodologies ours also considers the externalities of the supply chain when ascertaining the sustainability measures of a company. Our measurements take into account the company and all its suppliers up to the extraction of the raw materials needed for production.

While scores are often created based on ranking, we have introduced a score measure to assess sustainability representing a cost of externalities per euro of revenue generated by the corporate, e.g.: Volkswagen and the supply chain have a cost of 15 cents per euro of revenue generated.

Scope enables its users to access academic references and the data used in the methodology. Each step is described transparently and without any grey areas. All data is exportable so you can visualize the ESG impacts and keep 3rd parties informed about your portfolio.