Scope Ratings' methodology reflects a truly European approach to assessing underlying rating drivers. Compared to the larger credit rating agencies, we do not try to shoehorn regional differences into a global product. We are contributing to a greater diversity of opinions among rating agencies in today's capital markets to help investors and issuers make the best investment decisions possible.

Obtain the essential insights needed to support you in your credit risk assessments. With Credit Sphere, what you see is what you get. Our pricing structure is fair and predictable. We do not charge for ratings already paid for by the issuer. We make it easier for clients to use our credit ratings across their organisation and for any purpose.

We do not charge for ratings already paid for by the issuer.

Obtain a European perspective on your credit ratings.

Get access to credit ratings via one comprehensive marketplace.

Use credit ratings for any purpose within your organisation.

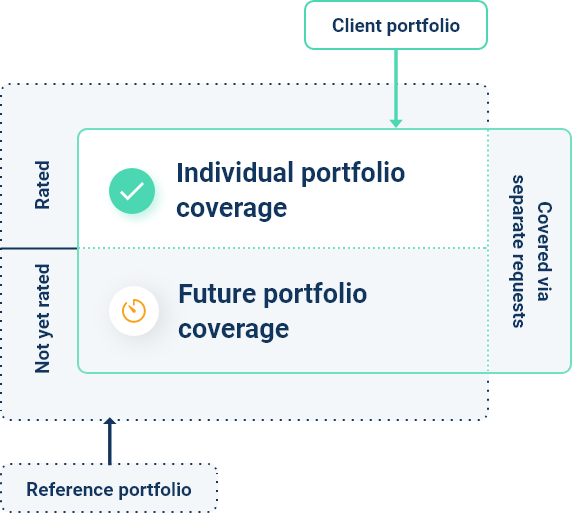

Your individual coverage is the share of your portfolio covered by the rated part of the reference portfolio.

You only pay for the rated part of your portfolio.

Scope Ratings is a credit rating agency registered in accordance with the EU rating regulation and classified as an External Credit Assessment Institution (ECAI).

Scope’s ratings are mapped by the European Supervisory Authorities and are on par with S&Ps, Moody’s and Fitch.